চৈত্র ১৪৩০

Sold Out

1430 Hoodies

Dacca Reversible Puffer Tote

Sold Out

Sold Out

Accessories

Tote Bags

Sold Out

Sold Out

Sold Out

Sold Out

Sold Out

Sold Out

Sold Out

Sold Out

Sold Out

কার্তিক - Kartik

Sold Out

Sold Out

১৪৩০

Sold Out

Poush-1429

Sold Out

Sold Out

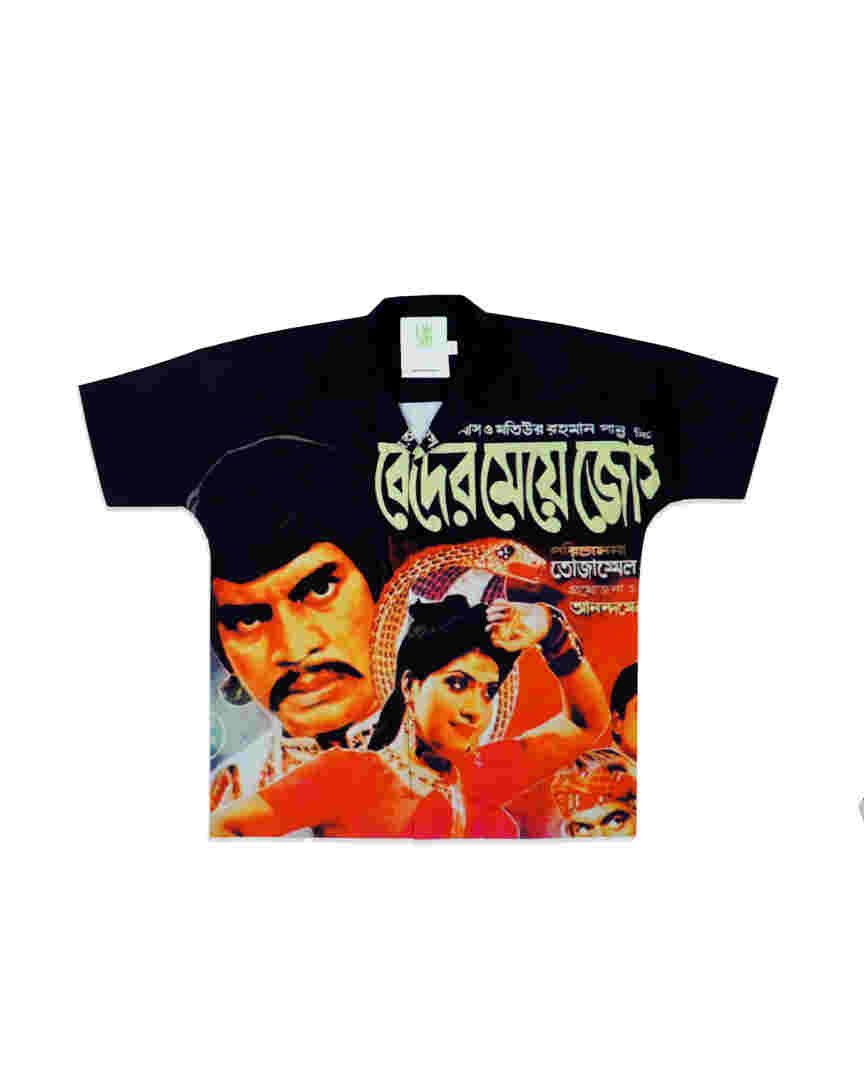

Capsule’22

Sold Out

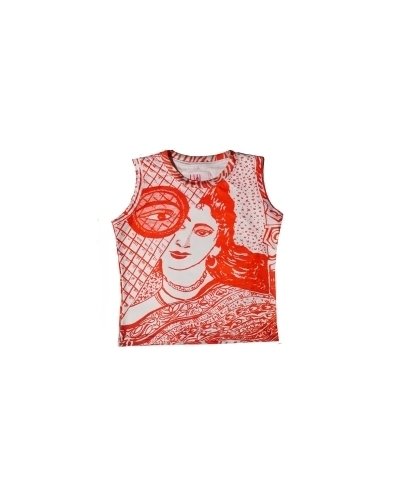

Hemen Majamdar Khadi Tshirts

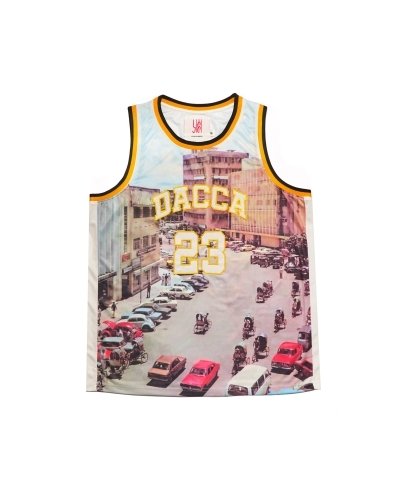

Boisakh 1429

AW'21

Sold Out

Sold Out